Effective October 3, 2019, the following frequently asked questions (FAQs) have been provided to assist financial institutions in their use of the FinCEN CTR.

As explained in FinCEN’s March 2012 guidance (FIN-2012-G002 ), for both critical and non-critical elements, financial institutions should complete those Items for which they have relevant information, regardless of whether or not the individual Items are deemed critical for technical filing purposes.

For critical Items, financial institutions must either provide the requested information or affirmatively check the “Unknown” (Unk.) box that is provided on the FinCEN CTR and FinCEN Suspicious Activity Report (SAR) (or any other FinCEN Report).

For non-critical Items, FinCEN expects financial institutions will provide the most complete filing information available within each report consistent with existing regulatory expectations. Based upon feedback from law enforcement officials, such information is important for query purposes. However, the new FinCEN SAR and FinCEN CTR do not create any new obligations to collect data, either manually or through an enterprise-wide IT management system, where such collection is not already required by current statutes and regulations, especially when such collection would be in conflict with the financial institution’s obligations under any other applicable law. Therefore, a financial institution may leave non-critical fields without an asterisk blank when information is not readily available.

FinCEN expects financial institutions to have the capability to submit information for any of the data fields in the FinCEN CTR or SAR (or any other FinCEN report). In general, if your financial institution’s filing software does not permit the institution to include information in a field without an asterisk where information has been collected and is pertinent to the report, the financial institution should instead complete a discrete filing for those transactions until the software is updated. If a filing has been submitted in which such information was not included because of such a limitation in the filing software, an amended filing should be completed using either the discrete filing method or an amended batch filing, once the software is updated. Such software updates should be implemented within a reasonable period of time.

If your institution has questions regarding the applicability of this general guidance, please contact the FinCEN Regulatory Helpline at (800) 949-2732 for further information.

“General users” of the Bank Secrecy Act (BSA) E-Filing System can only view those reports that the “supervisory user” has given them permission to see. If you cannot view or access the new FinCEN CTR, please contact your supervisory user to request access.

Supervisory users of the BSA E-Filing System are able to view all available FinCEN reports when they log into the BSA E-Filing System. The supervisory user must grant access for the general users to be able to view the new FinCEN reports.

To do so, a supervisory user first must:

1. Log into the BSA E-Filing System.

2. Select “Manage Users” from the left-hand side under “User Management.”

3. Select the general user whose access roles require updating.

4. Select “Reassign Roles.”

Upon reaching the next webpage, the supervisory user must:

1. Select the roles (“FinCEN CTR Filer,” “FinCEN CTR Batch Filer,” “FinCEN SAR Filer,” “FinCEN SAR Batch Filer,” “FinCEN DOEP Filer,” “FinCEN DOEP Batch Filer,” etc.) in the “Remaining Roles” box that need to be added for the general user.

2. Move those selected roles to the “Current Roles” box and select “Continue.”

After all these steps are completed, the general user will now have access to the selected new roles and can access the new FinCEN reports.

Electronic filing instructions can be found in Attachment C of the “FinCEN CTR Electronic Filing Requirements” document. This document can be found under “User Quick Links” of the BSA E-Filing System homepage (http://bsaefiling.fincen.gov/ ) or on the “Forms” page of the FinCEN Web site (http://www.fincen.gov/forms/bsa_forms/ ).

Additionally, instructions are embedded within the discrete filing version of the FinCEN CTR and are revealed when scrolling over the relevant fields with your computer “mouse.”

The filing name can be any name the financial institution chooses to use to identify the specific filing (e.g., Bank CTR 4-4-2012). The process for assigning filing names is for the financial institution to decide, and can assist the financial institution in tracking its BSA filings. We recommend using a naming convention that will be easy to understand and track for recordkeeping and audit/examination purposes.

Filers attempting to submit a corrected/amended CTR via the BSA E-Filing System should check “Correct/amend prior report” and enter the previous Document Control Number (DCN)/BSA Identifier (ID) in the appropriate field. The filer should complete the FinCEN CTR in its entirety, including the corrected/amended information, save (and print, if desired) a copy of the filing, and submit the filing. The corrected/amended FinCEN CTR will be assigned a new BSA ID.

To find your DCN/BSA ID for the previous filing, you will need the acknowledgement received by the general user after successfully submitting the report into the BSA E-Filing System. All general users assigned access to the new FinCEN reports automatically receive these acknowledgements. Filers can choose to receive these acknowledgements in an “ASCII” or “XML” format. Please also note that supervisory users cannot view the contents of the acknowledgements received by the general users.

If the previous DCN/BSA ID is not known, filers should enter all “zeros” (14 in total) for the previous DCN/BSA ID. This information was published in a Notice on October 31, 2011. This notice is applicable to corrections/amendments for any previous filing. The filer should complete the FinCEN CTR in its entirety, including the corrected/amended information, save (and print, if desired) a copy of the filing, and submit the filing. The corrected/amended FinCEN CTR will be assigned a new BSA ID that will be sent to the filer in the FinCEN CTR acknowledgement. The new BSA ID will begin with the number “31.”

The BSA E-Filing System is not a record keeping program; consequently, filers are not able to access or view previously filed reports. The BSA E-Filing System does provide tracking information on past report submissions and acknowledgements for accepted BSA reports. Users of the BSA E-Filing System must save and can print a copy of the FinCEN CTR prior to submitting it. FinCEN does not provide copies of filed reports to filers.

A BSA filing may be saved at any stage of completion and then reopened at a later time to complete and submit into the BSA E-Filing System. You must electronically save your filing before it can be submitted into the BSA E-Filing System. NOTE: The BSA E-Filing System is not a record keeping program. When saving a BSA filing, users must save the filing to their computer, network, or other appropriate storage device. For additional information about recordkeeping requirements under the BSA, please refer to 31 CFR § 1010.430(d) and FAQ #11.

Please note that the BSA E-Filing System will log filers off the system after a certain time period if there is no action within the account, even if the filer is working within the FinCEN CTR. For that reason, FinCEN strongly recommends that filers download the FinCEN CTR template, log out of BSA E-Filing, complete the FinCEN CTR off-line, and then log back into BSA E-Filing to upload and submit the report.

A filer can electronically save the filing to his/her computer hard drive, a network drive, or other appropriate storage device. By clicking on the “Save” button a standard dialog box will appear to allow you to choose the location for your saved report. Once the report is saved, the “Submit” button will become available. A filer may also want to print a paper copy for your financial institution’s records.

A filer should NOT save a copy of the report on a public computer or a computer that is not regularly accessed by the filer.This will ensure that the file remains appropriately secured.

After submitting a report via the BSA E-Filing System, filers are required to save a printed or electronic copy of the report in accordance with applicable record retention policies and procedures. Filers are reminded that they are generally required to keep copies of their filings for five years. See 31 CFR § 1010.306(a)(2), 31 CFR § 1010.330(e)(3), 31 CFR § 1010.340(d), 31 CFR § 1020.320(d), 31 CFR § 1021.320(d), 31 CFR § 1022.320(c), 31 CFR § 1023.320(d), 31 CFR § 1024.320(c), 31 CFR § 1025.320(d), 31 CFR § 1026.320(d), 31 CFR § 1029.320(d), and 31 CFR § 1022.380(b)(1)(iii).

FinCEN regulations have consistently maintained a regulatory requirement that CTRs be filed within 15 days. The 25-day period was implemented, in connection with receipt of magnetic media files (ended December 2008), to account for physically transporting (shipping) the magnetic media to the processing center in Detroit, Michigan. FinCEN understands that this business practice had continued with respect to batch e-filing, particularly considering previous public guidance referencing the 25-day period.

In light of the comments received and acknowledging that some financial institutions may have needed to change their business processes to become compliant with the rules, FinCEN determined that it would temporarily maintain the 25-day compliance period referenced in its earlier specifications until March 31, 2013, for those filers that needed to update their systems in order to be in compliance with the established regulatory requirements. This temporary extension to the filing requirements was to allow sufficient time for filers to adjust submission schedules to meet established regulatory requirements.

As of April 1, 2013, all FinCEN CTRs must be filed within 15 calendar days of the reported transaction(s).

Please ensure all of the following steps are followed when completing a single FinCEN CTR:

1. Complete the report in its entirety with all requested or required data known to the filer.

2. Click “Validate” to ensure proper formatting and that all required fields are completed.

3. Click “Sign with PIN” – Enter the personal identification number (PIN) the BSA E-Filing System has assigned to your user ID. If you do not know your PIN, please click on the “Manage PIN” link in the left navigation menu for your PIN to be displayed.

4. Click “Save” – Filers may also “Print” a paper copy for their records. The “Save” button will allow you to select the location to save your filing.

5. Click “Submit” – After clicking “Submit,” the submission process will begin.

After clicking “Submit,” the submission process begins. Once your filing is accepted into the BSA E-Filing System, a “Confirmation Page” pop-up will appear with the following information:

- Tracking ID (A unique tracking ID assigned to the filing by BSA E-Filing)

- Date and time of the submission

- Submission Type

- Owner (submitter) Name

- Owner (submitter) email address

- Filing Name

An email will also be sent to the email address associated with your BSA E-Filing account indicating your submission has been “Accepted” for submission into the BSA E-Filing System.

If the Confirmation Page pop-up is not displayed, your filing was not accepted for submission by the BSA E-Filing System. If you are returned to the BSA E-Filing System login page, your connection has timed out and you must login to the BSA E-Filing System and resubmit your report. It is recommended that you first close out of your browser and then re-open it before attempting to log into the BSA E-Filing System again.

Once your report is accepted and a confirmation page pop-up is displayed, the status of your report can be viewed by clicking on the “Track Status” link on the left navigation menu. The status will appear as “Accepted.”

Within 48 hours, your report will be formally acknowledged as having been successfully processed for inclusion in FinCEN’s data base. The status will change to “Acknowledged” in the “Track Status” view. In addition, a secure message containing the official BSA ID assigned to your report will be sent to your “Secure Mailbox.”

FAQs associated with Part I of the FinCEN CTR

Under the BSA regulations, the definition of “person” found at 31 CFR 1010.100(mm) is “an individual, a corporation, a partnership, a trust or estate, a joint stock company, an association, a syndicate, joint venture, or other unincorporated organization or group, an Indian Tribe (as that term is defined in the Indian Gaming Regulatory Act), and all entities recognizable as legal personalities.” Since an entity cannot physically conduct a transaction, the only selection that would apply is 2c “Person on whose behalf transaction was conducted.” In addition, if filing on an entity, a filer must select the checkbox (Item 4b) for “If entity” in Part I.

If more than one Item 2 option applies to a Part I person, a separate Part I section will be prepared on that person for each Item 2 option. For example, if the Part I person conducted a $5,000 deposit into their personal account and a separate $7,000 deposit into the account of another person/entity, there will be one Part I on that person reporting option 2a on the personal deposit with that amount and account number in Item 21 “Cash in amount”. There will be a second Part I on that person, reporting option 2b on the person/entity account transaction with that amount and account number in Item 21. Filers will proceed with creating a Part I for all other persons involved in the transactions, which in this example will be the person/entity on whose behalf the $7,000 transaction was conducted, reporting option 2c, with the $7,000 they are involved in and account number in Item 21.

Yes. All the individual transactions a financial institution has knowledge of being conducted by or on behalf of the same person during a single business day must be aggregated. Debits must be added to debits, and credits must be added to credits. If cash debit or credit totals exceed $10,000 in a business day, a CTR is required. If debits and credits each exceed $10,000, they can each be reported on a single CTR, but financial institutions should not off-set debits and credits against one another or reconcile for reporting purposes cash-in transactions with cash-out transactions. Multiple transactions in currency must be treated as a single transaction if the financial institution “has knowledge that they are by or on behalf of any person and result in either cash in or cash out totaling more than $10,000 during any one business day.”

In this regard, institutions should refer to FinCEN Rulings FIN-2001-R002 and FIN-2012-G001 . For example, the requirement to file a CTR may be triggered by an individual depositing more than $10,000 into multiple business accounts. In that case, the filing should be completed with those entities on whose behalf the transaction(s) were conducted and on the individual who conducted the transaction (Part I). In a situation where multiple withdrawals involving several individuals have occurred throughout the day, common ownership may be relevant to a determination that aggregation is required. If multiple businesses are not operating separately and independently, the institution may reach the conclusion that their transactions should be aggregated. A CTR would be completed indicating those entities on whose behalf the transaction(s) were conducted and those individual(s) conducting the transaction(s). Each entity and individual would be listed in a respective Part I. This reasoning has traditionally been extended to the exemption process as well.

Filers should check “Multiple transactions” (Item 3) if there were multiple cash-in or cash-out transactions of any amount conducted in a single business day by or for the person recorded in Part I. “Multiple transactions” is not the same as the Item 24 option “Aggregated transactions,” which only involves multiple transactions all of which are below the reporting requirements and requires at least one of the transactions to be a teller transaction. The use of Item 24 “Aggregated transactions” is discussed in more detail in FAQ #27.

For example, if Tom Doe deposited $6,000 to his personal account in the morning, and then later in the same business day deposited an additional $5,000 to his personal account, the filing institution would check Item 3 “Multiple transactions” when completing a Part I on Tom Doe. Another example would be if Tom Doe deposited $7,000 into ABC Restaurant’s business account and then later in the same business day Jane Smith deposited $5,000 into ABC Restaurant’s business account, the filing institution would check Item 3 “Multiple transactions” when completing a Part I on ABC Restaurant; however, the filing institution would NOT check Item 3 “Multiple transactions” when completing a Part I on Tom Doe or Jane Smith.

There may be instances where, at one time, an individual brings in funds to deposit to multiple accounts at the financial institution. Whether or not to check “Multiple transactions” in these instances depends on the financial institution’s procedures. For example, a customer brings in $15,000 and deposits the funds to three different accounts; the financial institution posts each transaction individually, choosing as a matter of policy to define each as a separate transaction. When completing Part I on the conductor, the financial institution would check Item 3 “Multiple transactions” as a result of its procedures to post the transactions individually and treat each one as a separate transaction.

FinCEN previously issued guidance in March 2012 that addressed the selection of the NAICS Code on the FinCEN CTR and FinCEN SAR. FinCEN emphasized that financial institutions will continue to be expected to provide only that information for which they have direct knowledge. As noted in that guidance, the issuance of the FinCEN CTR does not create any new obligation or otherwise change existing statutory and regulatory requirements for the filing institution. In addition, use of a NAICS code is not mandatory, and a financial institution may still provide a text response with respect to this information within the “Occupation” field. .

Please note that batch filers must use only the 3-4 digit NAICS codes on our approved list of codes. Discrete filers can select from the available drop-down list embedded within the CTR.

Please refer to FIN-2012-G002 for further information.

When recording the occupation, profession, or type of business of the individual or entity listed in Part I, use specific descriptions such as “doctor,” “carpenter,” “attorney,” “used car dealership,” “plumber,” “truck driver,” “hardware store,” etc. Generally, do not use non-descriptive items such as “businessman,” “merchant,” “retailer,” “retired,” or “self-employed.” If words like “self-employed,” “unemployed,” “homemaker,” or “retired” must be used, however, add the current or former profession if known (e.g., “self-employed building contractor,” “retired teacher,” or “unemployed carpenter”). Financial institutions should pay particular attention to customers with non-specific occupations who continually make large cash deposits.

For technical filing purposes, Item 20 is a critical field on the FinCEN CTR (identified by the *). However, the release of the FinCEN CTR did not create any new obligations or otherwise change existing statutory and regulatory expectations of financial institutions in filing the new report.

The previous guidance for completing the identification field on the CTR for an entity instructed filers to check the “Other” box and enter “NA” on the line provided. That instruction is no longer valid given the addition of the “Unknown” box for Item 20. The addition of the “Unknown” box means that filers will no longer use “NA” or “XX” in certain fields.

Therefore, if the filing institution does not have information available or knowledge of a “form of identification” for the entity, it should check the “Unknown” box for Item 20.

FinCEN expects, however, that financial institutions will provide the most complete filing information available within each report, regardless of whether or not the individual fields are deemed critical for technical filing purposes. Examples of “forms of identification” for an entity could include the entity’s business license or incorporation documents. Please refer to 31 CFR § 1010.312 for additional information on identification requirements.

Please note that if “Other” is selected in Item 20, you must either put in the number associated with that other form of identification or space fill the “Number” box to avoid a validation error.

Scenario: Tom Doe deposited $6,000 into his personal account. During the same business day, Jane Smith deposited an additional $5,000 into Tom Doe’s personal account.

In this scenario, the filing institution would complete three Part I’s, two for Tom Doe and one for Jane Smith. One Part I for Tom Doe would be completed by checking 2a "Person conducting transaction on own behalf" and entering $6,000 into Item 21 and the account number of his personal account. The other Part I for Tom Doe would be completed by checking 2c "Person on whose behalf transaction was conducted" and entering $5,000 into Item 21 and the account number of his personal account. The Part I for Jane Smith would be completed by checking 2b "Person conducting transaction for another" and entering $5,000 into Item 21 and the account number of Tom’s personal account.

How do I properly complete Part I on the FinCEN CTR for deposits into a joint account? What amounts do we show in Item 21 for each Part I? For example, John and Jane Smith have a joint account together. John Smith deposited $5,000 into the account; later in the same business day, Jane Smith deposited $7,000 into the account.

When a deposit is made into a joint account, the deposit is presumed to be made on the behalf of all account holders because all account holders have potential access to the account balance, and multiple Part Is are required. In this example, the financial institution would complete four Part Is, two for John Smith and two for Jane Smith since each person has more than one Item 2 role.

One of the Part Is for John Smith would be completed by checking 2a "Person conducting transaction on own behalf" and entering $5,000 into Item 21 and the account number of the joint account. The other Part I for John Smith would be completed by checking 2c "Person on whose behalf transaction was conducted" and entering $7,000 into Item 21 and the account number of the joint account. One of the Part Is for Jane Smith would be completed by checking 2a "Person conducting transaction on own behalf" and entering $7,000 into Item 21 and the account number of the joint account. The other Part I for Jane would be completed by checking 2c "Person on whose behalf transaction was conducted" and entering $5,000 into Item 21 and the account number of the joint account.

Note: If Jane Smith did not conduct a deposit, but John Smith deposited $12,000 into the joint account, there would only be two Part Is. One Part I would be for John Smith as 2a "Person conducting transaction on own behalf" and entering $12,000 in Item 21 and the account number affected. The other Part I would be for Jane smith, checking 2c "Person on whose behalf transaction was conducted," entering $12,000 in Item 21, and providing the account number affected.

24. How do I properly complete Part I on the FinCEN CTR for withdrawals from a joint account? What amounts do we show in Item 22 for each Part I? For example, John and Jane Smith have a joint account together. During one business day, John Smith withdrew $12,000 from the account.

Since John Smith made a withdrawal from the joint account in excess of $10,000, then the financial institution would list Jane Smith’s information only if it has knowledge that the transaction was also being conducted on her behalf. If the financial institution does not have knowledge that the withdrawal was conducted on behalf of Jane Smith, then it would neither be required to nor prohibited from listing Jane Smith in a second Part I.

Therefore, if the financial institution does not have knowledge that the withdrawal was conducted on behalf of Jane Smith, the financial institution would complete a Part I on John Smith. For Item 2 of Part I, the financial institution would check 2a “Person conducting transaction on own behalf” and complete the applicable information for John Smith. Item 22 for Part I on John Smith would be completed by entering $12,000 and providing the account number affected.

However, if the financial institution does have knowledge the withdrawal was completed on behalf of both John Smith and Jane Smith, the financial institution must complete two Part Is. In completing a Part I on John Smith, the financial institution would check 2a “Person conducting transaction on own behalf” and complete the applicable information for John Smith. In completing a Part I on Jane Smith, the financial institution would check 2c “Person on whose behalf transaction was conducted” and complete the applicable information for Jane Smith. Item 22 for each Part I would be completed similarly by entering $12,000 and providing the account number affected.

Scenario: Bob Smith deposits $6,000 into an account for ABC Hotel. Later in the same business day, Lisa Williams deposits $8,000 into an account for ABC Hotel.

The financial institution would complete three Part Is for the above scenario:

- A Part I on Bob Smith would be completed by 1) checking 2b “Person conducting transaction for another,” 2) completing the applicable information for Bob Smith, and 3) entering $6,000 in Item 21 and providing the account number affected.

- Another Part I on Lisa Williams would be completed by 1) checking 2b “Person conducting transaction for another,” 2) completing the applicable information for Lisa Williams, and 3) entering $8,000 in Item 21 and providing the account number affected.

- Another Part I on ABC Hotel would be completed by 1) checking 2c “Person on whose behalf transaction was conducted,” 2) checking Item 3 “Multiple transactions,” 3) checking “If entity,” 4) completing the applicable information for ABC Hotel, and 5) entering $14,000 in Item 21 and providing the account number affected.

Ans. Filers that are sole proprietorships and/or legal entities should follow the instructions in the CTR XML User Guide See https://bsaefiling.fincen.treas.gov/docs/XMLUserGuide_FinCENCTR.pdf. General Instructions Item 17, Reporting Sole Proprietorships, and Item 18 Legal Entities, on Page 90.

FAQs associated with Part I of the FinCEN CTR 112

Filers should check box 24e “Aggregated transactions” (along with any other box applicable in Item 24) only in the following circumstance: 1) the financial institution did not identify any of the individuals conducting the related transactions, 2) all of the transactions were below the reporting requirement, and 3) at least one of the aggregated transactions was a teller transaction. If the aggregated transactions being reported included only deposits made via a night depository, the financial institution would not check “Aggregated transactions” as none of the aggregated transactions were a teller transaction; instead, the financial institution would check Item 24 “Night Deposit.” A “teller transaction” would include, but would not be limited to: the deposit or withdrawal of currency by an individual at the teller window, an individual making a loan payment with currency at the teller window or, an individual exchanging currency at the teller window. The option “Aggregated transactions” is not the same as Item 3 “Multiple transactions,” which can involve transactions that are above the reporting requirement.

For example, if there were four $3,000 deposits made into ABC Restaurant’s business account in one business day, and the filing institution did not identify any of the individual transactors, and at least one of these deposits was made via a teller transaction, the filing institution would complete a Part I on ABC Restaurant checking Item 3 “Multiple transactions” and checking “Aggregated transactions” in Item 24.

However, if the filing institution identified the fourth individual transactor, as a result of knowing the transaction takes ABC Restaurant over the $10,000 threshold, then the filing institution would complete a Part I on ABC Restaurant checking Item 3 “Multiple transactions” and a separate Part I on the fourth individual transactor. The filing institution would NOT check “Aggregated transactions” in Item 24 due to the fact that it identified one of the transactors.

If there were four $3,000 deposits made into ABC Restaurant’s business account via any combination of Armored car (FI Contract), ATM, Mail Deposit or Shipment, or Night Deposit, i.e., without any of the deposits being made via a teller transaction, the Aggregated transactions box should not be checked. Instead, the other boxes in Item 24 should be checked to the extent that they are applicable.

Yes, this is acceptable, if the difference was a result of a financial institution following the instructions on rounding dollar amounts. The following scenario outlines the two choices available for the filing institution to follow in completing Items 21/22 and Items 25/27:

Scenario: A customer deposits $8,345.18 into his or her personal account and also makes a loan payment of $2,345.43 in the same business day. The daily report shows this customer brought in $10,690.61 in one business day.

- Option 1: Per the FinCEN CTR instructions, each dollar amount reported on the FinCEN CTR is to be rounded-up to the next dollar. Therefore, the financial institution would enter $10,691 in Part I Item 21 of the FinCEN CTR. In Part II, the financial institution would enter $8,346 in Item 25a and $2,346 in Item 25b. As a result, the total in Item 25 would reflect $10,692. The FinCEN CTR will validate and be accepted as the total in Item 21 (or Item 22 for a cash-out transaction) is not more than the total for Item 25 (or Item 27 for a cash-out transaction). Filers can internally document as a general note to their FinCEN CTR files that the amounts may differ in these situations as a result of following the FinCEN CTR rounding instructions. Both regulators and law enforcement were involved in the designing of the FinCEN CTR, and are aware and accepting of the possible discrepancy.

- • Option 2: As a means of avoiding these differences on the FinCEN CTR, the filer can round up all the amounts involved separately and then aggregate the separately rounded amounts. For example, using the above scenario, the filer would round-up the $8,345.18 and $2,345.43 transactions separately, to $8,346 and $2,346, respectively, which would aggregate to $10,692 and then enter this amount in Part I Item 21 of the FinCEN CTR. In Part II, the financial institution would enter $8,346 in Item 25a and $2,346 in Item 25b. As a result, the total in Item 25 would reflect $10,692 and Items 21 and 25 would match. If applicable, a financial institution should still internally document as a general note to its FinCEN CTR files if these amounts differ slightly from the amounts shown on the daily reports due to rounding the amounts involved separately.

Until FinCEN directs otherwise, if euros are involved and the country of origin is unknown, enter “BE” for Belgium in Item 26/28, as applicable.

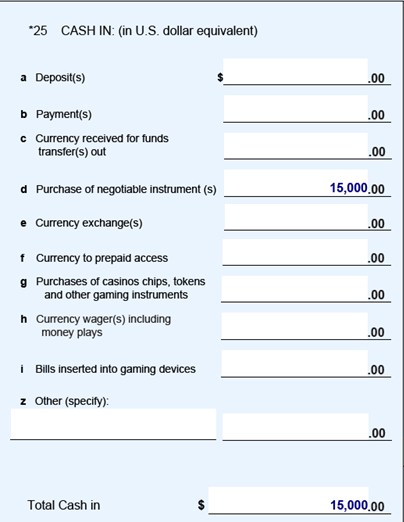

Banks may implement a policy requiring customers who are deposit accountholders and who want to purchase monetary instruments with currency to first deposit the currency into their deposit accounts (while treating this two-step process as one transaction). Nothing within the BSA or its implementing regulations prohibits a bank from instituting such a policy. Therefore, if a customer purchases a monetary instrument using $15,000 in currency that the customer first deposits into the customer’s account, whether at the requirement of the bank or at the customer’s discretion, the financial institution would complete Part I of the FinCEN CTR with the customer’s information. In Part II Item 25, the financial institution would indicate $15,000 as cash in for Item 25d “Purchase of negotiable instrument(s)” as shown below. Completing the FinCEN CTR in this manner will notify law enforcement that the currency was used to purchase a negotiable instrument.

FAQs associated with Part III of the FinCEN CTR

When filing the FinCEN CTR for a reportable transaction(s), the filing institution should complete a Part III for each location where the reportable transactions took place. The FinCEN CTR allows for up to 999 Part IIIs (Financial Institution Where Transaction(s) Takes Place) to be entered on a single filing. If the transactions take place at the branch level, the information regarding the financial institution locations where the transactions took place should be that of the branches involved.

Discrete filers: To enter additional Part IIIs using the discrete filing version of the FinCEN CTR, the filing institution would select the “+” icon in Part III.

Batch filers: Batch filers will utilize the Financial Institution Where Transaction(s) Take Place (2B) Record for this same purpose. The 2B record identifies information regarding the financial institution where transaction(s) took place. The number of 2B records is dependent on the number of branches the Parent Financial Institution Information (2A) record is reporting on the file. There must be at least one 2B record for each financial institution reporting under the 2A Record. Filers are permitted to associate up to 999 2B records for a single currency transaction report. The 2B record precedes all transaction records for the financial institution. Multiple 2B records must be grouped together prior to the associated Transaction Summary (3A) Record(s).

The following are examples of the two batch filing formats involving multiple 2B records that would meet the technical specifications for the FinCEN CTR so the file would be technically acceptable for submission into the BSA E-Filing System as well as permit the data to be loaded properly to reflect the correct associations between the 2B and 3A record(s):

Scenarios

CTR-1: two transactions, each in a different branch (b-1, b-2)

CTR-2: one transaction in a single branch (b-3)

CTR-3: two transactions, each in a different branch (b-1, b-3)

CTR-4: one transaction in a single branch (b-4)

CTR-5: one transaction in a single branch (b-4)

E-File (Variant A)

2A (FI)

2B (b-1)

2B (b-2)

3A (CTR-1)

[3B-4C not addressed to simplify example]

9A (b1-2 summary)

2B (b-3)

3A (CTR-2)

[3B-4C not addressed to simplify example]

9A (b3 summary)

2B (b-1)

2B (b-3)

3A (CTR-3)

[3B-4C not addressed to simplify example]

9A (b1,3 summary)

2B (b-4)

3A (CTR-4)

[3B-4C not addressed to simplify example]

3A (CTR-5)

[3B-4C not addressed to simplify example]

9A (b4 summary)

9B (FI Summary)

E-File (Example B)

2A (FI)

2B (b-1)

2B (b-2)

3A (CTR-1)

[3B-4C not addressed to simplify example]

9A (b1-2 summary)

2B (b-3)

3A (CTR-2)

[3B-4C not addressed to simplify example]

9A (b3 summary)

2B (b-1)

2B (b-3)

3A (CTR-3)

[3B-4C not addressed to simplify example]

9A (b1,3 summary)

2B (b-4)

3A (CTR-4)

[3B-4C not addressed to simplify example]

3A (CTR-5)

[3B-4C not addressed to simplify example]

9A (b4 summary)

9B (FI Summary)

A depository institution would select the Research, Statistics, Supervision, and Discount (RSSD) number. You can find your institution’s RSSD number at http://www.ffiec.gov/nicpubweb/nicweb/nichome.aspx.

When the transaction takes place at a branch location, you should include the RSSD number associated with that branch. If the branch location at which the transaction occurred does not have an RSSD number, however, leave all of Item 40 blank. This may occur if an RSSD number has not yet been issued for a new branch, but we expect few depository institutions to not have an RSSD for each branch. If the branch has the same RSSD number as the financial institution as a whole, you should use the overall financial institution RSSD number. This will occur with credit unions.

Please note that it is important to have the information within the filing regarding the branch or other location at which the transaction took place as complete and accurate as possible. This greatly assists law enforcement in understanding where the transactions took place

The filing institution should enter the name of the office that should be contacted to obtain additional information about the report. It is the filing institution’s choice as to which office this should be. Examples may include the “Compliance Office,” “Security Office,” “BSA Office,” or “Risk Management Office.” The office may or may not be located at the location identified in the same Part III.

Yes, the filing institution’s contact phone number should be the phone number of the contact office noted in Item 55.

Additional questions or comments regarding these FAQs should be addressed to the FinCEN Regulatory Helpline at 800-949-2732. Financial institutions wanting to report suspicious transactions that may relate to terrorist activity should call the Financial Institutions Toll-Free Hotline at (866) 556-3974 (7 days a week, 24 hours a day). The purpose of the hotline is to expedite the delivery of this information to law enforcement. Financial institutions should immediately report any imminent threat to local-area law enforcement officials.